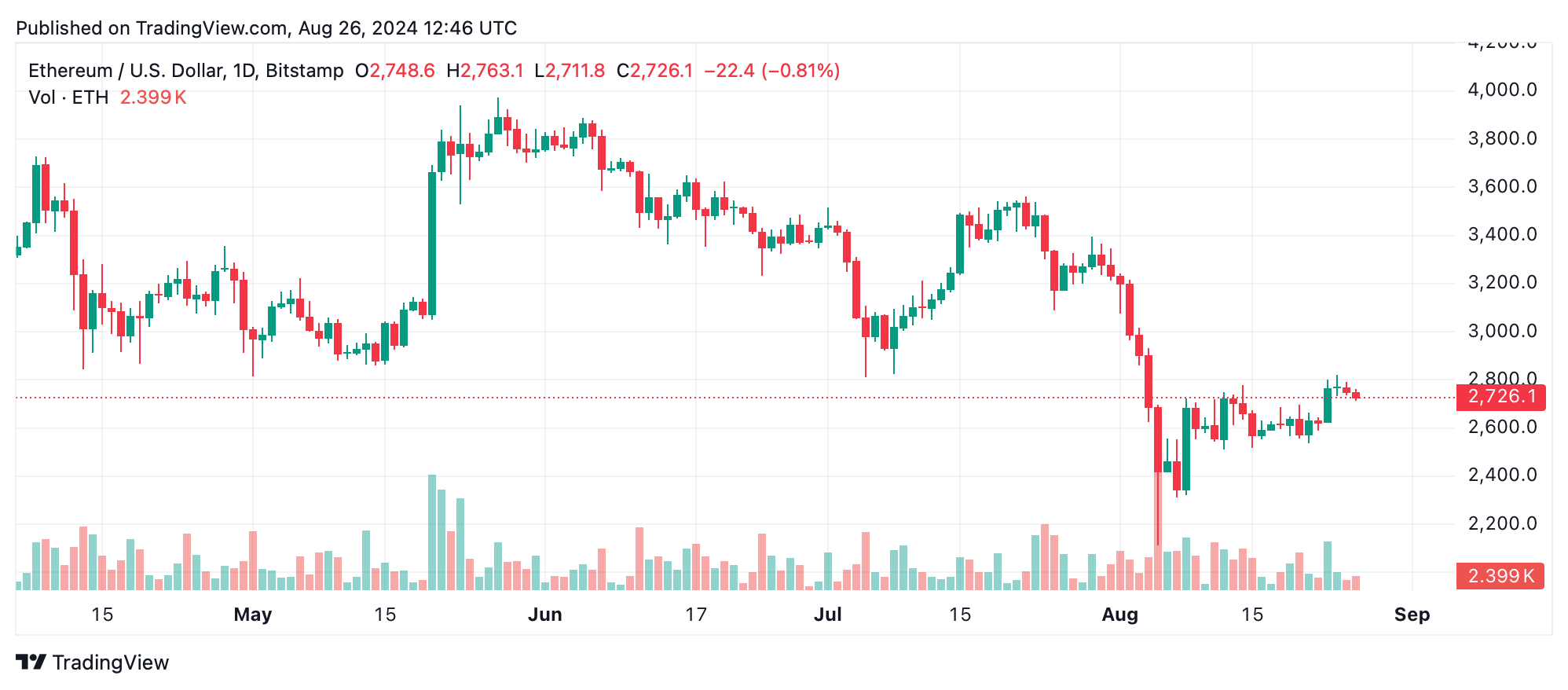

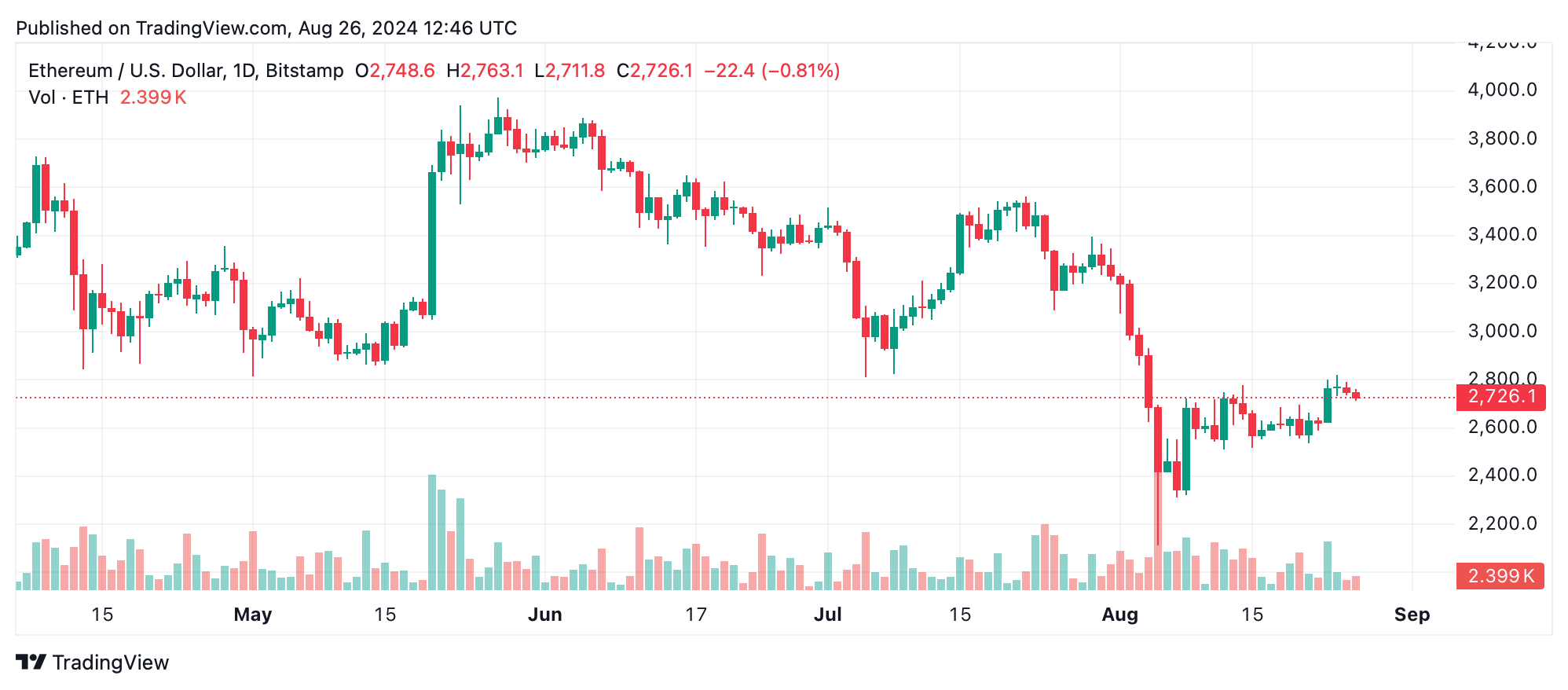

On August 26, 2024, ethereum’s price hovered around the $2,739 mark, reflecting a cautious market sentiment as traders weigh the potential for further gains against looming resistance. Technical indicators across multiple timeframes reveal a mixed outlook, with key support and resistance levels tightly defining ethereum’s near-term trajectory.

Ethereum

Ethereum’s daily chart shows a strong downtrend that dominated early August, with prices plummeting from $3,400 to a low of $2,017. This sharp decline has since been followed by a period of consolidation between $2,600 and $2,800. The volume has been mixed during this consolidation, suggesting a lack of clear direction among traders. Key support remains firm at $2,017, while the $2,800 resistance level continues to challenge upward momentum.

The 4-hour chart provides insight into a short-term uptrend that began around August 21, pushing ethereum’s price from $2,535 to a high of $2,823. However, this upward momentum has shown signs of weakening as the price stabilizes just below $2,800. The volume during this period was higher during the ascent but has since diminished, indicating reduced buying pressure as ethereum approaches critical resistance.

On the 1-hour chart, ethereum exhibits a range-bound behavior, with the price oscillating between $2,712.6 and $2,793.5. This pattern reflects the market’s indecision, as traders appear hesitant to push the price beyond these established levels. Volume spikes during the decline from $2,793.5 to $2,712.6 hint at selling pressure, though the overall volume remains subdued during the consolidation phase.

Oscillators reveal a mixed picture, with the relative strength index (RSI) at 48.4, indicating neutrality. The commodity channel index (CCI) at 115.2 suggests a potential sell signal, while the moving average convergence divergence (MACD) level of -62.7 points to a possible buy. Momentum indicators are similarly divided, with the awesome oscillator and Stochastic both neutral, reflecting the broader uncertainty in the market.

Finally, moving averages (MAs) present a complex scenario. Shorter-term averages, such as the 10-period exponential moving average (EMA) and simple moving average (SMA), signal buying opportunities, with prices currently above these averages. However, longer-term moving averages, including the 50, 100, and 200-period EMAs and SMAs, all suggest a bearish outlook, with prices trading below these averages. This divergence between short and long-term indicators underscores the tension in ethereum’s current market position.

Bull Verdict:

If ethereum manages to break through the $2,800 resistance with strong volume, it could signal the start of a new upward trend, potentially driving the price back toward the $3,000 level. Short-term indicators support a bullish outlook, especially if buying momentum increases.

Bear Verdict:

However, failure to breach the $2,800 resistance, coupled with the bearish signals from long-term moving averages, could lead to a retest of lower support levels around $2,600 or even $2,500. A breakdown below these supports could trigger further downside, reinforcing the bearish trend observed on the daily chart.

What do you think about ether’s market action on Monday? Share your thoughts and opinions about this subject in the comments section below.

Comments 0